You may have noticed ‘bullish divergence’ and ‘bearish divergence’ while following the cryptocurrency market over the previous year. But what is meant by these terms, and how can they help you trade cryptocurrencies?

Explaining divergence and why it is significant in technical analysis

Australians are an extremely diverse group of people with many different cultures and backgrounds. This assortment is one of their strengths, and it is essential to remember that when they are working together.

They all bring different skills, knowledge and experiences to the table, and by tapping into this diversity, we can achieve great things. One area where this is specifically essential is in technical analysis. Divergence is the difference between two sets of data, and traders can use it to identify trends and make predictions about future movements in the markets.

Bullish and bearish divergence in crypto

In the early days of bitcoin trading, Australians were some of the most enthusiastic adopters, with several local businesses quick to start accepting BTC as payment. This enthusiasm has continued in recent years, with Australia one of the most active markets for trading and investing in cryptocurrency.

However, there’s been an exciting development in the Australian crypto space in recent months; a growing divergence between bullish and bearish sentiment. Some believe that the current bull market is just getting started and that crypto is on the verge of mass adoption. There is a belief that the bubble will burst and that prices are due for a sharp correction. This divergence of opinion reflects a broader uncertainty in the market, and it will be interesting to see how it works out in the months ahead.

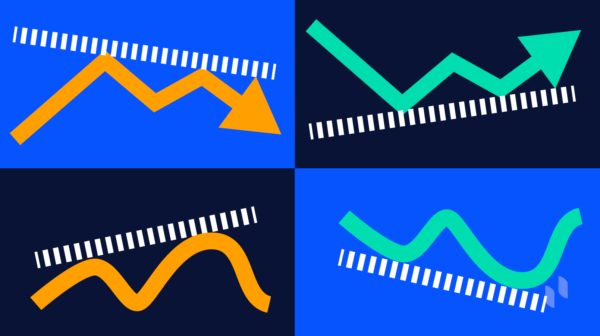

How to spot bullish and bearish divergence in charts

Australians are among the most sophisticated investors in the world. So, it’s essential to listen when they start talking about bullish and bearish divergence in charts. Bullish divergence transpires when the price of an asset is making new lows, but the underlying indicator is starting to move higher.

It is often seen as a sign that the sellers are exhausted and near a reversal. On the other hand, bearish divergence happens when the price of an asset is making new highs, but the underlying indicator is starting to move lower. It often indicates that the buyers are running out of steam and that a top may be forming.

Of course, spotting divergence is just one part of the puzzle, and it’s also essential to understand trendlines, support/resistance levels, and other technical indicators before making investment decisions. But for Australians who want to get ahead of the pack, learning to spot bullish and bearish divergence is a good place to start.

Examples of bullish and bearish divergence in popular cryptocurrencies

Australians are increasingly turning to cryptocurrencies as an investment opportunity. However, with the volatile nature of digital currencies, it is essential to understand the signs of bullish and bearish divergence.

Bullish divergence arises when the price of a cryptocurrency rises while the underlying indicator is falling. It often happens during market consolidation and can signify that the coin is about to enter a bullish breakout.

A bearish divergence comes about when the price of a cryptocurrency falls while the indicator is rising, and it can signify that the coin is about to enter a bearish downtrend. By understanding these two types of divergence, Australians can decide when to buy or sell their digital assets.

Tips for trading with divergence

Australians love to trade. We’re a nation of passionate investors, and we’re always on the lookout for new opportunities. However, remember that not all trades are created equal. One type of trade that can be particularly tricky is divergence trading. Here are some tips to navigate the world of divergence trading:

- Make sure you do your research. This deal might be complicated; therefore, it’s critical to grasp the underlying principles thoroughly.

- Be patient. Divergence trades can take time to play out, so it’s essential to have patience and stay the course.

- Have a plan. Trading without a plan is asking for trouble. Make sure you know your entry and exit points before entering a trade.